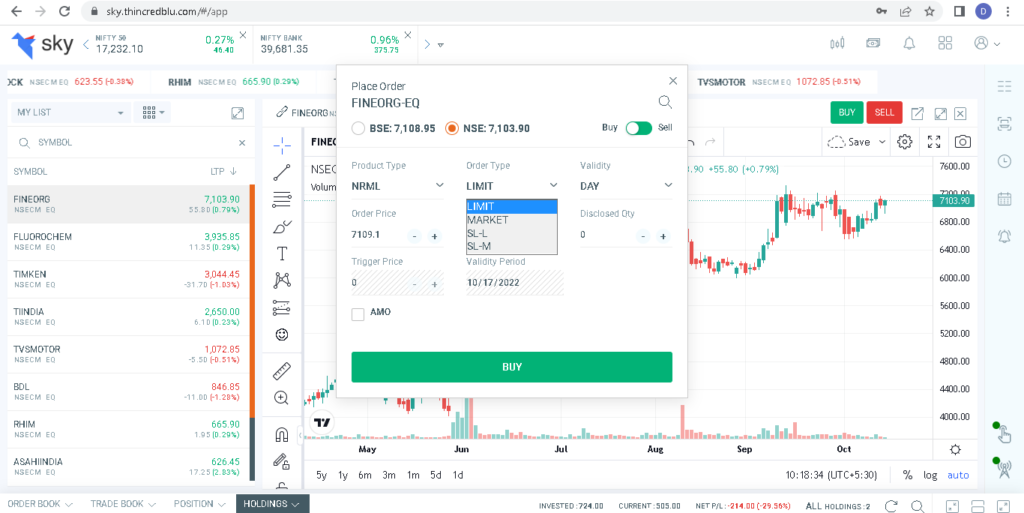

Limit Order – Limit order allows one to buy or sell a stock at a specified/ price or a better price. For example, if you place a buy limit order at 100, then your order will get filled/executed at or below 100 and not more than that. Your order may get executed at 99.90 or even lower if that is the case.

Market Order – Market order allows one to buy/sell at the best available price. If the quantity is large, then order will get executed at different prices and average price will be considered.

Stop Loss Order (Limit and Market) – A stop loss order is a type of order where you specify a trigger price at which either a limit or market order is placed. Trigger price is the price at which your buy or sell order becomes active for execution at the exchange servers. Stop loss order is a passive order, once the price crosses the trigger levels, it becomes an active order.

BO Order – A bracket order is a type of order (intraday only) where you can enter a new position along with a target/exit and stop-loss order. As soon as the main order is executed, the system will place two more orders (profit-taking and stop loss)